The new Herstatt banking house

On 10 December 1955, Iwan David Herstatt’s lifelong dream came true. With the help of investors (banker Eugen Neuvians from Munich, Hans Gerling from Cologne (insurance), major Swiss shareholder Emil Bührle and others), the new banking house I.D. Herstatt was established in the form of a KG a.A.. Iwan D. Herstatt became the sole personally liable partner. For the foundation, Bankhaus Hocker & Cie. was purchased, which was on the market due to the death of the owner, and accordingly renamed I.D. Herstatt. As the premises of Bankhaus Hocker were far too small, the company immediately developed a new building in Cologne, Unter Sachenhausen 6, which was designed according to the most modern aspects and was ready for occupation in May 1957 with 70 employees.

Emil Bührle died at the end of 1956 and Hans Gerling took over the shares. Eugen Neuvians visited Mr Gerling in Cologne and also wanted to increase his share package. When Mr Gerling kept him waiting, the two men had a heated exchange of words with the result that Mr Gerling also took over Mr Neuvians’ share package and now had a dominant role with more than 80% of the shares. Iwan Herstatt had acquired around 5% of the shares from the beginning.

Growth towards becoming Germany’s largest private bank

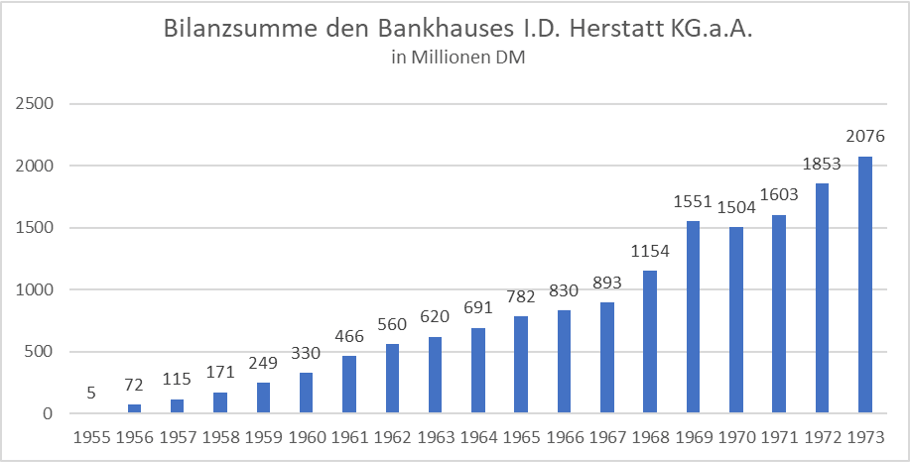

The bank gradually developed into a bank of supra-regional importance, ultimately becoming the largest private bank in Germany with 850 employees. In addition to the headquarters in Cologne and an extensive network of branches in Cologne and Bonn, the bank had subsidiaries and representative offices in Frankfurt, Luxembourg, Toronto and London. The balance sheet total grew continuously from an initial DM 5 million in 1955 to over DM 2 billion in 1973.

The Herstatt Bank was a universal bank and offered the entire range of banking services. Iwan D. Herstatt had clear ideas about how a private bank should be run and how it should stand out from the anonymous big banks. If possible, every customer should be greeted by name as soon as they entered the bank. If possible, customer letters should be answered on the same day, and bills should be paid on the day they arrive. The customer’s request for a meeting should be granted at short notice. Iwan Herstatt, who had a phenomenal memory for numbers and knew the account numbers of several hundred customers by heart, amazed the customers again and again and thus gave them the feeling that they were important to the bank and received first-class service. Iwan D. Herstatt was a gifted networker and had recognised that clubs (Lions, Overseas Club, sports clubs, automobile clubs, cultural development clubs) and in Cologne especially the carnival clubs were ideal opportunities for high-profile customer acquisition. Accordingly, he was active in more than 30 carnival societies and 20 other associations as an honorary member or as treasurer. In addition, he held 19 mandates in supervisory boards and advisory boards of well-known companies. Iwan D. Herstatt was supported in his work by 10 directors and just as many department directors. In addition to Mr. Herstatt, there was another personally liable partner, so that the areas of responsibility could be divided up. The first, Heinrich von Pauker, died early of a brain tumour, much to his regret. He was followed by Joachim-Hans von Hinckeldey, who left the company after a heated dispute with major shareholder and chairman of the supervisory board Hans Gerling. Bernhard Graf von der Goltz joined the company as the third partner, initially as a general representative. As he had extensive experience abroad, he was given responsibility for the foreign department and the associated foreign exchange department. With the rapid growth of the bank, a broad-based top management would certainly have been necessary, which Iwan Herstatt also always advocated. Unfortunately, he received little support from the main shareholder Hans Gerling. It is striking that Mr Herstatt’s partners were always aristocrats. Mr Gerling attached great importance to this, which considerably limited the choice.

Foreign exchange trading

In 1972, the currency parities were reorganised within the framework of Bretton Woods and the dollar exchange rate was freed up. The so-called floating opened up new opportunities in the foreign exchange business and a separate foreign exchange department was set up accordingly. On the one hand, customers were offered exchange rate hedging transactions with which they could compensate for risks arising from exchange rate fluctuations in their international goods deliveries. Proprietary transactions were also offered, in which one speculates on rising or falling exchange rates of a currency with two coordinated transactions, a buy order and a sell order (suitable in terms of timing and volume). As soon as the countertrade is concluded, a profit or loss is realised. Initially, one could make relatively safe profits with these trades, since the $, for example, was far overvalued and was constantly losing value. Also, only a few people were well acquainted with the subject, so that one could recognise the direction of the currency developments through a head start in know-how, good technical equipment and still with quite simple means. For example, it was enough to look at the trade balances of the countries and where they were negative, one could expect falling exchange rates. Today, this is no longer so easy, because through networking and the use of millions of computers, all knowledge is already priced into the prices.

Daniel (Dany) Dattel, who had been with the bank since 1961, took over the management of the foreign exchange department. The management gave fixed guidelines (amount of open positions and total volume) on how far the bank was allowed to take own risks. The Herstatt Bank took a leading role in foreign exchange trading and many banks tried to poach the head of the foreign exchange department. The year 1973 was a loss-making year for most banks, but Herstatt-Bank shone with an excellent annual profit, partly due to its involvement in foreign exchange trading. Due to the extensive foreign exchange trading, rumours arose again and again, but the internal analyses showed no abnormalities. Neither the internal audit nor commissioned auditors could find anything. Only once did a letter from the Moscow Narodny Bank turn up by chance, referring to a foreign exchange transaction for which there was no internal booking. This was explained to Iwan D. Herstatt with an unfortunate computer error. Iwan D. Herstatt noted on the letter “huge mess, rebook immediately”.